Small Business Bookkeeping Made Easy!

Streamline Your Small Business' Finances with our Expert Bookkeeping Services for Small Business

Professional bookkeeping services

tailored for small businesses

Welcome to our professional Bookkeeping Services for Small Business.

At ProfitAbility Virtual Assistance, we understand the challenges you face when it comes to managing your finances.

Our goal is to provide you with comprehensive solutions that save you time, reduce stress, and drive your business towards financial success.

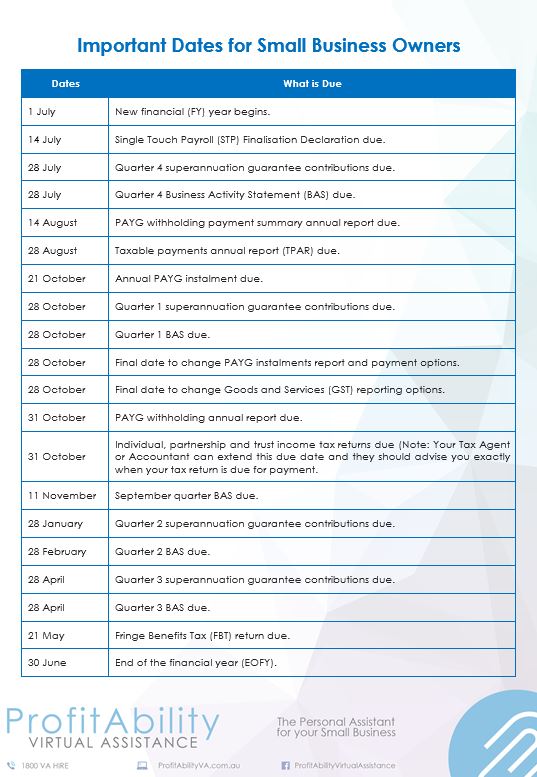

As a small business owner, we know that staying organised, processing your BAS' on time and managing your cash flow are your biggest priorities.

With our Small Business Bookkeeping Solutions, you can trust us to handle these challenges efficiently and effectively.

Let us remove your stress and overwhelm and ensure that your bookkeeping is in order and that you remain compliant with the Australian Taxation Office.

Benefits of Outsourcing your Small Business Bookkeeping Solution:

Outsourcing your bookkeeping brings numerous advantages.

By choosing our Small Business Financial Bookkeeping services, you gain cost savings, access to expertise, increased accuracy, and the freedom to focus on your core business activities.

Trust us to handle your financial records while you concentrate on driving your business forward.

Your next BAS is due to be lodged in

Your next BAS is due to be lodged in

Bookkeeping software we love

We are proud of our certifications, affiliations, and partnerships that demonstrate our commitment to excellence.

Our utilisation of industry-leading software and adherence to best practices ensure that your books are in safe hands.

With us, you can have confidence in our reliable bookkeeping services for small business.

Simplify Your Bookkeeping

with Our Expert Team

Our team of experienced professionals specialises in various aspects of bookkeeping.

From bank reconciliations, payroll processing, and BAS preparation to financial statements and accounts payable/receivable management, we offer comprehensive support with your Small Business financial administration.

With our expertise and attention to detail, you can focus on growing your business while leaving the bookkeeping to us.

BAS

Ensuring your quarterly Business Activity Statement is accurate and submitted to the Australian Taxation Office in a timely manner is one of the most important tasks a Small Business Owner needs to do.

ACCOUNTING SOFTWARE

With experience in Xero, QuickBooks Online, MYOB, Reckon Accounts and so much more, we can recommend the right product to meet your unique needs and your budget.

SUPERANNUATION

If you would like support with setting up or processing your Small Businesses superannuation, then our team of qualified Bookkeepers are here to do just that.

PAYROLL

Do you need help setting up your employees, processing their pay runs, approving their timesheets and leave or submitting their super? If so, our Team is here to support you with what you need.

BANK RECONCILIATIONS

Are your bank reconciliations driving you crazy or you simply don't have enough time in the day to process them? Then let our Bookkeepers get you back on track.

SINGLE TOUCH PAYROLL

Do you need to set up your accounting software for Single Touch Payroll compliance. We can connect your software with the Australian Taxation Office and have you compliant in no time.

BANK FEEDS

If your bank feed is getting out of control or the transactions are confusing you, then our BAS Agents and Bookkeepers can help you to get it back on track in no time.

BUDGETING

Our budgeting support helps you take control of your finances with confidence. We create practical budgets, monitor results, and guide you to make smart choices that strengthen your business performance.

PAYG

Keep the Australian Taxation Office happy by submitting an accurate Instalment Activity Statement on time every month or quarter. If you are running out of time or need some support, be sure to reach out to our BAS Agents for help.

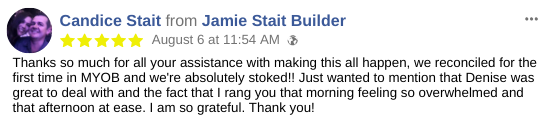

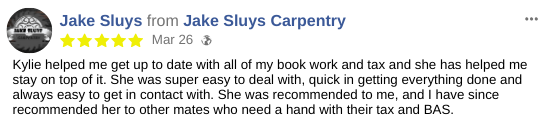

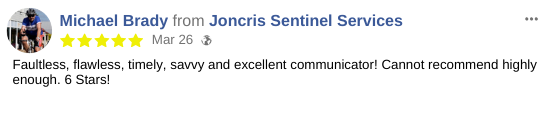

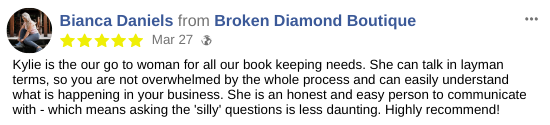

Don't just take our word for it!

Our track record speaks for itself. Check out these kind words that other small business owners across different industries have to say about us. They have experienced firsthand how our financial management services helped their Small Businesses, and brought them peace of mind and improved their financial operations. Join their ranks and experience the difference today.

Why not join them and experience our support for yourself today?

Bookkeeping Services Small Business Support Packages

All prices inclusive of GST

Bookkeeping

by a BAS Agent

$95 per hour

- Processing your bookkeeping and BAS requirements by a qualified BAS Agent

Bookkeeping Health Check & Report (Once Off)

$195 per check

- Know exactly what needs urgent attention in your current bookkeeping file

Ready to take the next step?

Let's chat about your Bookkeeping

Do you have a question or three about the best way to take care of your small business bookkeeping?

Then secure your Bookkeeping Strategy Session today!

Let us show you how our Small Business Accounting Services can benefit your business. Time is of the essence, so don't hesitate to reach out.

Contact Us

We're here to assist you and we're happy to answer any questions or provide further information.

Let's start building a successful partnership today.

Kylie Ufer

Denise Sandilands

Kirsten Wilson

Choosing the right bookkeeping package

Are you looking for a bookkeeping package to use in your small business?

The options can be confusing.

Cut through the noise and check out our blog/video to see the pros and cons of each of the market leaders.

Frequently Asked Questions

Have questions? We've got answers.

Check out our FAQ's to find responses to common inquiries. We want to ensure that you have all the information you need to make an informed decision about our Small Business Financial Record-Keeping services.